Introduction

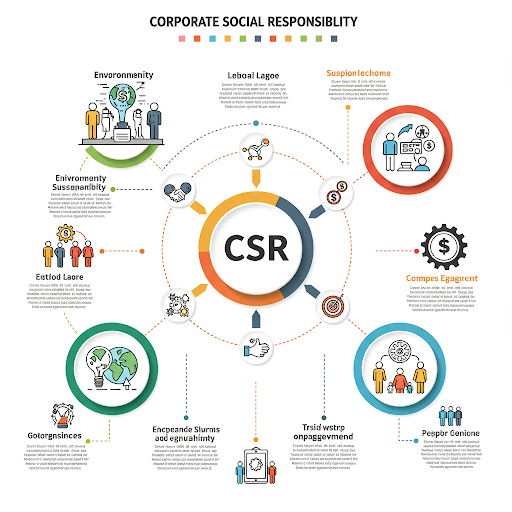

Corporate Social Responsibility (CSR) refers to a company’s commitment to operate in an economically, socially, and environmentally sustainable manner while balancing the interests of diverse stakeholders. Essentially, CSR goes beyond the pursuit of profits to include the company’s impact on society and the environment, aiming to contribute positively to communities and sustainable development.

Regulatory Framework

In India, CSR is primarily governed by the Companies Act, 2013, particularly through Section 135. This framework mandates that eligible companies allocate a specified percentage of their profits towards CSR activities. The regulatory environment is further supported by guidelines and notifications from the Ministry of Corporate Affairs (MCA) and, for listed companies, the Securities and Exchange Board of India (SEBI) may also provide related directions.

Applicability

CSR provisions under the Companies Act, 2013, are applicable to companies that meet certain financial thresholds. Specifically, a company must comply if, in any financial year, it has:

- A net worth of INR 500 crore or more,

- A turnover of INR 1000 crore or more, or

- A net profit of INR 5 crore or more.

Companies meeting any of these criteria are required to spend on CSR initiatives.

CSR Committee

For companies falling under the ambit of CSR requirements, the Act mandates the formation of a CSR Committee. Key points include:

- Composition: The committee must consist of at least three directors, including at least one independent director.

- Responsibilities: It is tasked with formulating a CSR policy, recommending projects, monitoring the progress of CSR activities, and ensuring that the spending is in line with the provisions of the Act.

CSR Activities

The Act outlines various categories of activities that can be considered as CSR initiatives. These activities broadly include:

- Eradicating hunger and poverty

- Promoting education and healthcare

- Environmental sustainability and protection

- Gender equality and empowerment

- Rural development and infrastructure

- Other activities that contribute to social and community welfare

Companies have the flexibility to choose projects that align with their business ethos and societal needs, as long as they fall within the prescribed domains.

CSR Policy

A formal CSR Policy is a critical requirement under the Act. The policy should:

- Detail the company’s CSR objectives: Define the scope and areas of focus.

- Outline the implementation strategy: Specify the initiatives, timelines, and methods for monitoring and evaluation.

- Align with stakeholder interests: Ensure that the chosen projects address relevant social issues and are consistent with the company’s overall strategy.

The board of directors is responsible for reviewing and approving this policy, ensuring it integrates seamlessly with the company’s long-term business strategy.

CSR Expenditure

Under the Act, companies eligible for CSR must allocate at least 2% of their average net profits from the preceding three financial years towards CSR activities. Key aspects include:

- Budget Allocation: Companies need to plan their financial commitment in advance.

- Implementation and Auditing: The expenditure is subject to audit, ensuring that funds are used efficiently and transparently.

- Utilization of Funds: Any unspent amount should be disclosed along with the reasons for non-utilization, and the company must explain how it intends to deploy those funds in subsequent periods.

Disclosure Requirements

Transparency is a cornerstone of the CSR framework. Companies are required to:

- Publish details in their annual report: This includes the CSR policy, projects undertaken, and financial details of CSR expenditure.

- Update on their website: Many companies now maintain a dedicated section for CSR, providing ongoing updates and detailed disclosures.

- Explain deviations: If the mandated CSR spending target is not met, companies must provide reasons and outline future plans for utilizing unspent funds.

This level of disclosure helps stakeholders assess the company’s commitment and the impact of its CSR initiatives.

CSR u/s 135 of Companies Act, 2013

Section 135 of the Companies Act, 2013, encapsulates the following key mandates:

- Mandatory CSR Spending: Companies meeting the defined financial thresholds are required to spend at least 2% of their average net profits over the previous three years on CSR activities.

- Formation of a CSR Committee: A dedicated committee, which must include independent directors, is tasked with designing and overseeing the CSR policy.

- CSR Policy: Companies must establish a clear, documented CSR policy that outlines the specific projects and areas of work.

- Focus Areas: The law specifies broad areas for CSR activities, including poverty alleviation, education, healthcare, environmental sustainability, and more.

- Transparency and Reporting: Companies must publicly disclose their CSR policies, initiatives, and financial expenditure, ensuring accountability and transparency in how CSR funds are utilized.

The overarching aim of these provisions is to ensure that companies contribute meaningfully to social development while integrating CSR into their overall business strategy.

This comprehensive framework not only helps companies meet regulatory requirements but also fosters a culture of corporate accountability and social responsibility, benefiting society at large.