These rules help banks decide how to open and manage current accounts for businesses. In simple terms, they explain what happens when a company borrows money and how the bank will handle the company’s bank accounts depending on the size of its borrowing.

What Counts as “Borrowing” and Who Are the Banks?

Borrowing: When we talk about a company’s “exposure,” we mean the total amount of money that the company has borrowed or agreed to borrow from banks. This includes both loans (money you get directly) and other credit facilities (such as credit lines).

Banks Involved: Only certain types of banks are part of these rules. They include big commercial banks and payments banks (but not all kinds of financial institutions).

How Banks Open Current Accounts for Borrowers Who Already Have a Credit Facility

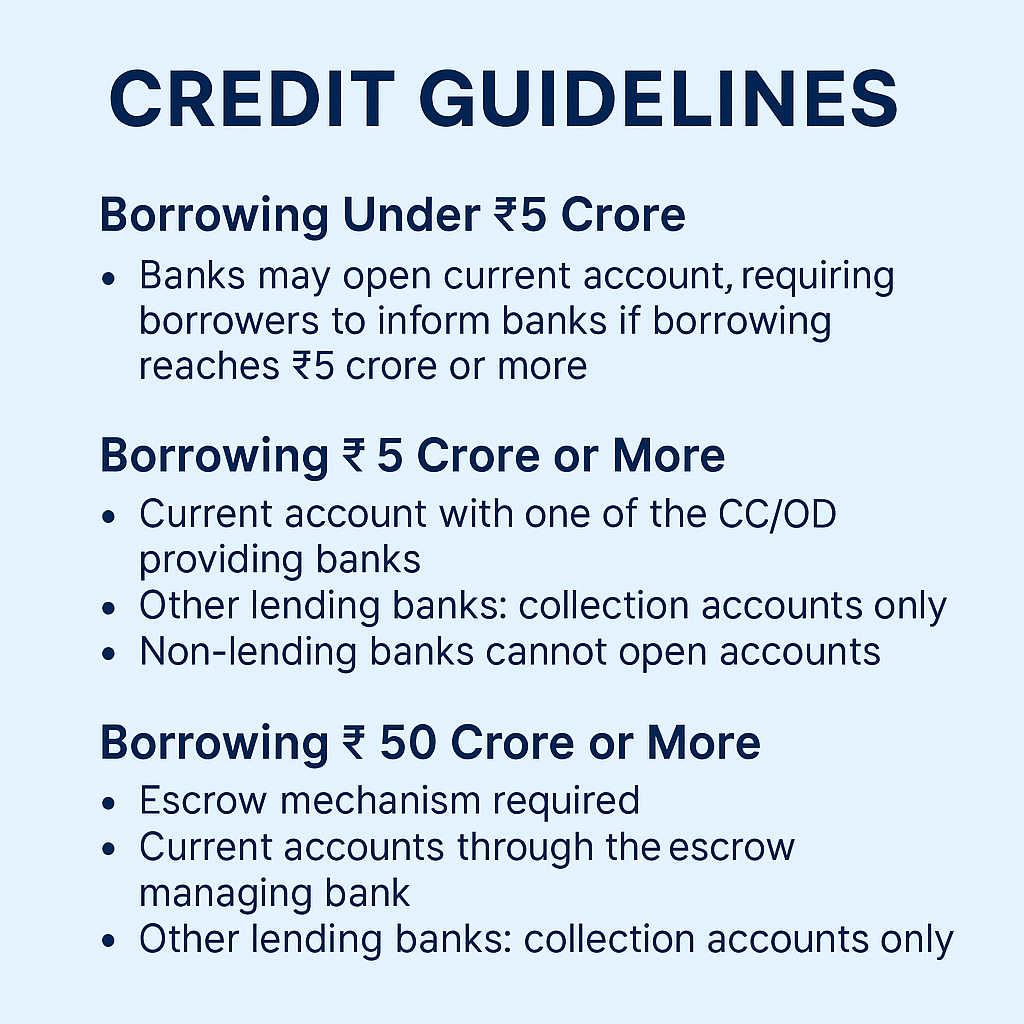

If Your Total Borrowing Is Less Than ₹5 Crore

Easy Account Opening: If your borrowing is under ₹5 crore, banks can open your current account without any complicated rules.

Your Responsibility: You just need to promise (in writing) that you’ll let the bank know if your borrowing ever reaches ₹5 crore or more.

If Your Total Borrowing Is ₹5 Crore or More

Choosing the Right Bank for Your Main Account:

Main Account: You can have a regular (current) account with a bank if that bank is already lending you money and holds at least 10% of the total loans you have with all banks.

If No Bank Holds 10%: Then the bank that has lent you the most will open your current account.

Other Banks’ Accounts:

Other banks may only open special “collection accounts.” These are not full current accounts. Instead, any money that goes into these accounts must be sent to your main current account within two working days.

The balances in these accounts cannot be used to secure additional loans or credit.

Non-Lending Banks: Banks that are not already providing you with a loan or credit cannot open any account (current or collection) for you.

How Banks Handle Accounts for Borrowers Who Do Not Already Use a Cash Credit/Overdraft

If Your Borrowing Is ₹50 Crore or More

Escrow Arrangement:

An escrow is like a special holding account where all funds are managed according to an agreed plan.

You choose one bank (called the escrow managing bank) to handle your main account, and all the banks that lend you money become part of this arrangement.

Other Banks’ Accounts:

The other banks are only allowed to open “collection accounts” where funds must be regularly transferred to the escrow account.

Non-Lending Banks: They are not allowed to open a current account for you.

If Your Borrowing Is Between ₹5 Crore and ₹50 Crore

Lending Banks: Banks that have already given you loans can open regular current accounts without extra restrictions.

Non-Lending Banks: These banks can only set up collection accounts for you.

If Your Borrowing Is Less Than ₹5 Crore

Simple Start: Banks can open a current account for you as long as you commit to notifying them if your borrowing grows to ₹5 crore or more.

Rules Kick In Later: Once you cross the ₹5 crore or ₹50 crore mark, the rules for those higher amounts (as explained above) will apply.

For New Customers Without Any Loans

Starting Fresh: Banks may open current accounts for new customers after doing their usual checks, even if you haven’t borrowed from them yet.

Special Cases

Different Lenders: If you have loans only from non-bank institutions like NBFCs (non-banking financial companies), banks can open current accounts for you without these restrictions. But if you later borrow ₹5 crore or more from banks, these rules will then apply.

Special Exempt Accounts

Some types of accounts are not affected by these rules because they are set up for specific purposes. These include:

Real Estate Accounts: For example, accounts used in property projects to hold a set percentage of advance payments from home buyers.

Escrow Accounts for Payment Systems: These are used by payment aggregators or prepaid systems.

Accounts for Specific Financial Transactions: Such as those used for IPOs, share buybacks, dividend payments, or other statutory (by law) purposes.

Foreign Exchange Accounts: Accounts set up under guidelines for managing foreign exchange.

Tax or Statutory Payment Accounts: Accounts used to pay taxes or other government dues.

Settlement Accounts for Payment Cards: For example, those dealing with debit/ATM or credit card payments.

Accounts for Cash Management: Such as those managed by companies that handle cash transportation or replenishment.

Inter-Bank and Special Institutional Accounts: Accounts between banks or accounts for institutions like NABARD, NHB, or SIDBI.

Court or Government Mandated Accounts: These accounts are set up by law or on government orders.

For these special accounts, banks need to ensure that the funds are used only for the intended specific activities and should monitor them closely.

How Banks Will Monitor and Adjust These Arrangements

Regular Reviews: Banks will check every six months to see if your total borrowing has increased and if your account type needs to be changed according to the rules.

Timely Updates: If there is a change, banks must update your account arrangements within three months.

No Extra Hassles: Banks are also responsible for ensuring that the rules are followed without causing unnecessary inconvenience to you as a customer.

Special Note on Term Loans

Direct Payment: For loans given for a specific purpose (like buying goods or services), the money should be sent directly to the supplier or the correct party—not to your current account.

Exceptions: If it’s not clear where the money should go, the bank may use your current account to process the payment. But, everyday operating expenses can still go through your account.

Try Our Simple Credit Discipline Utility

Not sure which rule applies to your business account? Use our quick and easy utility to get an instant recommendation based on your borrowing amount.

👉 Use the Tool Now